sales tax on leased cars in arizona

These leases are subject to county and city transaction privilege taxes. Normally the sales tax would be added to the monthly payment on the lease what would happen hereI seem to have 2 choices 1- add the ca sales tax which is more than az to the leasewhat happens to the tax when registered here.

Is It Better To Buy Or Lease A Car Taxact Blog

Arizona last updated this percentage in 2013 when it was reduced from 66 to the current rate of 56.

. The state sales tax rate in Arizona is 5600. This includes but is not limited to. If that 21 a month makes that much difference to you then yes try to get out of the lease but Ill bet they wont let you without paying a penalty that will be more than the difference in.

Calculate Car Sales Tax in Arizona Example. Leasing in California Arizona Resident - Sales Tax. Heres an explanation for.

Although you may be using auto financing to cover a large portion of the purchase you still must pay the sales tax on the full price of the car. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

This page describes the taxability of leases and rentals in Arizona including motor vehicles and tangible media property. The majority of states assess and include the sales tax on each monthly payment. Sales Tax 45000 - 5000 - 2000 056 Sales Tax 2128.

I am buying a new car in ca from a dealer and shipping it to scottsdale az. A Report of SaleUsed Vehicle REG 51 if applicable. 55167 x 108 59580.

If the lessee sold the vehicle to a third party two transfer fees are due in addition to any other fees due. Counties and other local jurisdictions can also add a tax rate on top of the. Price of Accessories Additions Trade-In Value.

To learn more see a full list of taxable and tax-exempt items in Arizona. A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. Select the Arizona city from the list of popular cities below to see its current sales tax rate.

General sales tax in my city is 825 including state and county as well. This page covers the most important aspects of Arizonas sales tax with respects to vehicle purchases. For example if the monthly lease payment is 300 and the sales tax is 8 percent the total payment is 324.

For vehicles that are being rented or leased see see taxation of leases and rentals. Where you lease the vehicle from is irrelevant unless you pick a state that charges all taxes up front. Generally when a car is rented or leased in Florida the payment is subject to Floridas six percent 6 state sales tax rate and any county sales tax on each lease payment.

However some states calculate the sales tax differently. Dwight047 December 25 2019 632pm 3. Most businesses pay the tax liability on a quarterly basis.

Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment. Like with any purchase the rules on when and. Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees.

This notice may help protect you from liability if the vehicle is. It will be a leased vehicle. Tax Paid Out of State.

Arizona has several transaction privilege taxes including a use tax local option sales taxes an aircraft use tax residential rental and peer-to-peer car rental taxes. The most common method is to tax monthly lease payments at the local sales tax rate. Use tax is due.

Used for criminal activity. The sales tax on a lease depends on what state and county the vehicle is registered in. This means you only pay tax on the part of the car you lease not the entire value of the car.

Discover the Latest Promotions on Nissans Award Winning Lineup. Arizona has recent rate changes Wed Jan 01 2020. It probably is just sales tax difference perhaps some other tax.

Ask for a breakdown. Involved in an accident. While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This page describes the taxability of leases and rentals in Arizona including. With local taxes the total sales tax rate is between 5600 and 11200. When you sell trade-in end your lease donate or otherwise transfer ownership of your vehicle you must notify MVD by immediately completing a sold notice.

Sales tax is a part of buying and leasing cars in states that charge it. For example even though Delaware has no state sales tax it currently charges a document fee of 425 of the purchase price of a vehicle or the NADA book value whichever is more. A transfer fee in addition to any other fees.

And tax reciprocity with Arizona meaning that the nonresidents state will provide a credit for the Arizona state TPT amount paid by the nonresident purchaser at the time of the sale. In comparison to other states Arizona ranks somewhere in the middle. Arizona has recent rate changes Wed Jan 01 2020.

Office buildings stores factories farm land parkingstorage facilities banquet halls or meeting rooms. I believe Maricopa is 63 but not 100 sure. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy.

Transaction privilege tax Sales tax The states sales tax base rate is 56 percent. So your lease payments here are 280 a month instead of 259 in MN. A commercial lease is real property leased or rented for commercial purposes.

The math would be the following. This is a free service. This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment.

Arizona collects a 66 state sales tax rate on the purchase of all vehicles.

A Complete Guide On Car Sales Tax By State Shift

Gladly Bmw Bmw 4 Series Gran Coupe

How To Gift A Car A Step By Step Guide To Making This Big Purchase

5 Dealer Options To Skip When Buying A Car Bankrate

Which U S States Charge Property Taxes For Cars Mansion Global

Nj Car Sales Tax Everything You Need To Know

Open House Sunday Oro Valley 5br Pool Spectacular Http Www Orovalleyrealestateandhomes Com Openhouse Oro Valley Spa Pool Pool

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Bill Of Sale Template

2021 Arizona Car Sales Tax Calculator Valley Chevy

What S The Car Sales Tax In Each State Find The Best Car Price

Do You Pay Sales Tax On A Car Down Payment Green Light Auto Credit

1953 Herz Rent A Car Ad El Mirador Hotel Palm Springs Red Convertible Car Midcentury America Vintage Vacation Advertisi Rent A Car Car Ads Travel Ads

Keyes Orlando Jaimes Van Nuys Specials For This Holiday Weekend Hyundai Santa Fe Hyundai Santa Fe 2015 2014 Hyundai Santa Fe

Going To Phoenix On Vacation How About Atv Rental Atv Rental Atv Jet Ski Rentals

Rent A Moturis Rv For Your Winter Holiday And Take Advantage Of An Amazing All Inclusive Package At Low Low Rates Package Rv Rental Rv All Inclusive Packages

19 Campbell Is A Single Story Retail Neighborhood Shopping Center Located In Phoenix S Commercial Real Estate Broker Real Estate Lease Commercial Real Estate

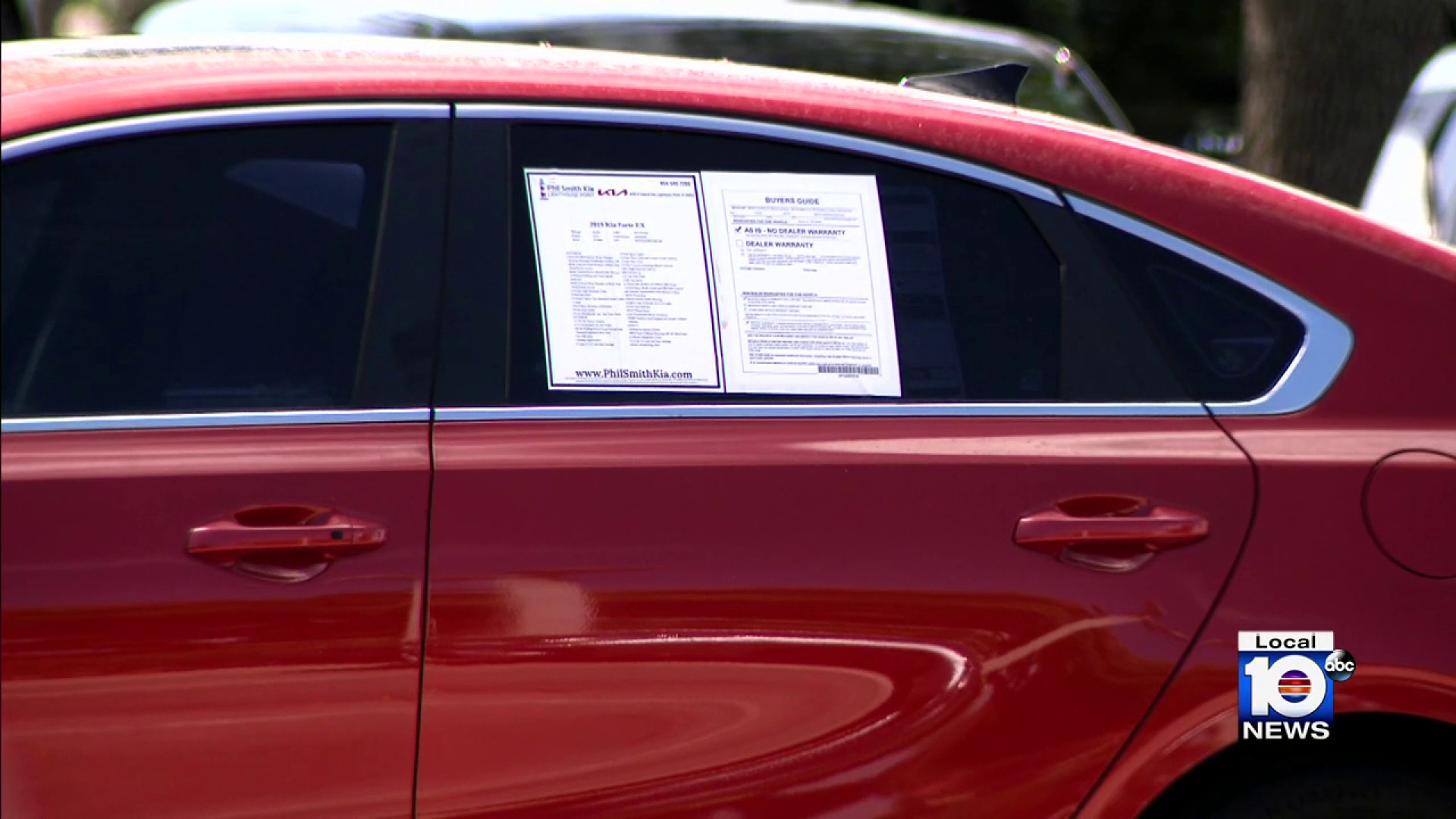

Did You Pay A Dealer Fee When Buying Out Your Lease If So You Re Entitled To A Refund Attorney Says